Written by Adrienne Parkhurst on Sep 17, 2021

Is Your Technology Partner Providing a Digital-First Payment Experience?

46% of consumers rate the healthcare industry as the most difficult when it comes to paying bills.

Like it or not, consumers continue to demand more digital innovation from their providers. COVID-19 changed both patient and provider behavior, with 65% of patients using telehealth last year. The latest Healthcare Payments Insight Report from Elavon shows a rapid acceleration in digital-first payment trends, proving the demand for a retail-like payment experience is here.

Meeting Patient Expectations Means Offering Multiple Payment Options

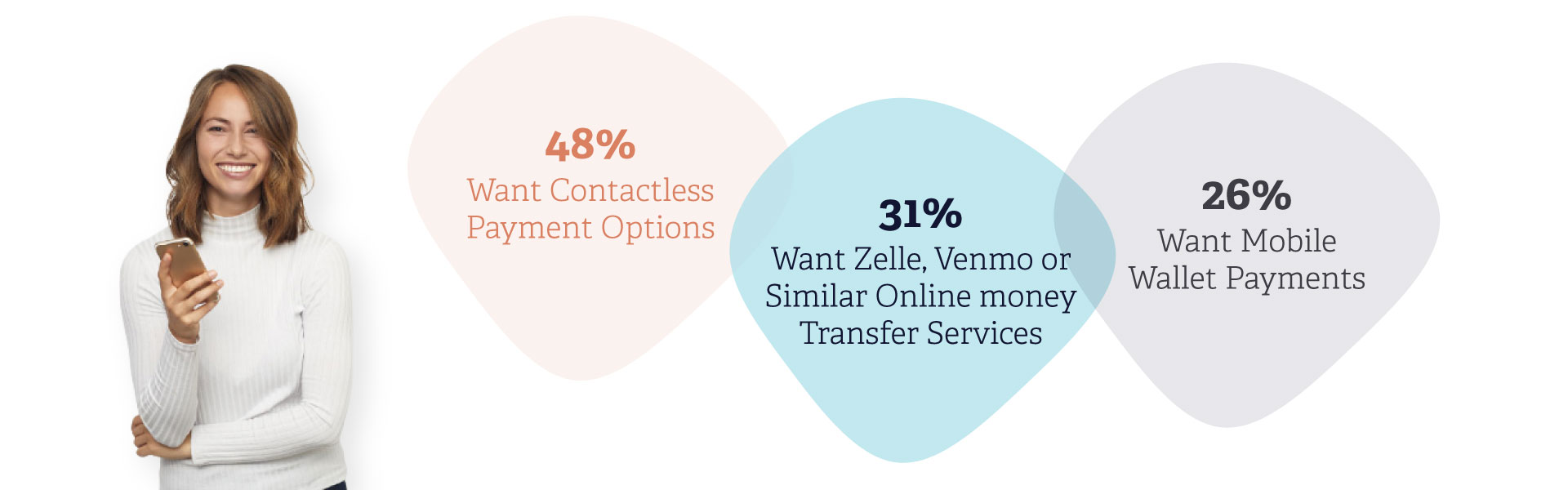

Data from the Payment Insight Report shows that 58% of consumers prefer contactless payments. Some patients want to swipe their credit cards, while others prefer using their mobile wallet with NFC technology.

Healthcare consumers want traditional providers to offer a more simple, flexible, and secure digital experience that matches what they experience with online retailers. Patients also want contactless payment options. Research shows that 76% of consumers are also concerned about payment device sanitation. Unfortunately, healthcare providers lag behind other industries when it comes to innovative, consumer-driven payment experiences.

What if the Healthcare Digital Experience Mirrored Other Industry’s Digital Interactions?

COVID-19 accelerated the use of technology across several industries, especially the food industry. Consider how we, consumers, interact with restaurants now. We use mobile apps to order food for takeout or delivery. With just a few clicks, we customize how our order is cooked, delivered, and paid.

Improved technology has led to personalized, integrated, seamless, and frictionless experiences in other consumer-facing industries. Department stores and grocers partner with technology vendors to offer multiple ordering and payment methods, allowing consumers to choose the best option for their needs. Some customers may select an in-person experience, while others choose curbside delivery.

Why can’t health system technology do the same?

Healthcare Is Moving Toward a More Integrated, Data-Driven Experience

From online scheduling to virtual visits, hospitals are adopting consumer-facing digital technologies. These technologies enable providers to create a digital front door to their facility and interact directly with patients. A well-constructed digital front door not only expands access to care, but it optimizes the patient payment experience.

As David Schulz, Chief Operating Officer at Salucro, states, “more health providers and vendors [need to] provide solutions and work with their clients and their customers to offer a broader set of payment solutions and engagement solutions for their patients.”

The data from the Elavon Payment Insight Report helps the healthcare industry understand patient payment trends and preferences. This information also helps healthcare leaders select the right technology partners when building or enhancing their digital front door.

The Right Technology Vendor Enables Providers to Offer a Patient-Centric Payment Experience that Improves Consumer Engagement and Loyalty

We asked two incredible technology leaders to discuss how their clients learned to adapt to consumer-facing technology demands. In this informative webinar, they offer excellent advice based on their experiences optimizing the digital patient experience.

As part of our Healthcare Fintech Webinar Series, Tyler Eppley, Vice President, Head of Healthcare Payment Solutions for U.S. Bank, and David Schulz, Chief Operating Officer for Salucro discuss how the right technology can help to create a patient-centered experience.

They advise healthcare revenue cycle leaders to follow these five considerations when choosing a technology partner, and how the right technology helps to optimize your patient payment experience.

1. Advanced Patient Engagement

Healthcare providers must develop patient-centric technology solutions to compete in an ever-changing consumer marketplace.

Patients consider themselves healthcare consumers - they shop around, and they do their homework. 70% of consumers say positive online reviews are crucial when selecting a healthcare provider.

Patients expect top-level service and expertise from their providers. With more financial responsibility shifting to patients, they’re taking ownership over their care. And they expect more for their money.

Providers need to simplify and optimize their patient payment experience - 46% of consumers rank healthcare as the most difficult industry to make a payment. Healthcare consumers want convenient access to clinical care, medical information, pricing, and billing.

A provider’s digital payment solution should be an extension of their brand. 32% of consumers say the ability to use contactless payment options improves the perception of the provider. Providers must build a patient-centric payment experience.

2. Modern Payment Acceptance

Consumers want multiple choices when it comes to paying their bills. In the Healthcare Payments Insight Report, consumers were asked which payment methods they want from their healthcare providers.

These innovative technologies also impact a provider’s brand. Patients view providers as savvy when they offer new digital payment options like mobile wallets or consumer-to-business payments. These money transfer services, like Zelle®, Venmo®, and PayPal® have become a preferred way for younger healthcare consumers to pay – particularly during the pandemic.

The report also found that consumers worry about healthcare affordability. 66% of adults in the U.S. worry about unexpected medical bills. When providers offer technology that demystifies pricing and billing, it reduces their patients’ stress and allows them to focus on their health and wellness.

A patient-centric payment solution that enables patients to pay some of their costs at the point of service and defer the balance for later self-service payments also helps alleviate the financial burden of unexpected medical bills. A patient-centric technology solution will provide multiple payment options using simple, flexible, and secure methods.

3. Integrated Services

Providers need to create a better digital front door for their patients. As David Schulz, Chief Operating Officer at Salucro, states, “[the patient portal] is no longer an endpoint, it’s really more of an extension of the brand.”

When consumers were asked how providers could modernize their payment options, the top request was for an online portal to be added or updated. By optimizing their patient portals, providers can build better digital front doors that engage their patients and improve consumer loyalty.

The way consumers interact with healthcare has changed. The competitive market and ever-changing technology mean traditional healthcare providers must compete with tech giants who offer better digital experiences.

Patients want integrated workflows for their check-in process, real-time patient statements, and payment experiences. And all of these tools must be highly secure and safe to use regardless of whether the patient pays their bill at a doctor’s office or from their couch. The digital patient experience should be consistent and seamless regardless of the type of device used or the location of the payment transaction.

Patients expect providers to offer an integrated digital billing and payment process. Healthcare consumers should be treated like consumers in any other industry. With more options available to patients, providers must earn their loyalty.

4. Ability to Adapt

Technology changes fast. It’s critical to choose a payment technology partner that’s easily adaptable to changing consumer and market needs. Consumers expect a savvy retail-like payment experience across the entire health system. This requires providers to implement nimble and simple patient-centered payment processes.

Tyler Eppley, Vice President, Head of Healthcare Payment Solutions at U.S. Bank advises, “the new technology should be an integrated platform that operates across all different payment channels, instead of just solving for one.” Consumers expect technology integration, and patients expect providers to offer consistent, seamless technology regardless of their transaction - clinical or financial.

A digital-first approach to payments provides simple, convenient, and adaptable tools for patients. This further extends providers’ brands and strengthens their market position.

5. Security & Compliance

Consumers want modernized payment options, but they worry about the security of providers’ mobile payment systems. Healthcare Payments Insight Report research shows that 55% of consumers worry about security when paying healthcare bills via mobile apps.

With the rise in cyber-attacks and online scams, a technology solution must have the highest quality data encryption from the point of entry. It’s imperative to choose technology with an integrated P2PE PCI validated security solution.

The right technology will secure and protect both the provider and patient’s information and strengthen your brand’s trustworthiness in the process.

Consumers expect providers to offer a retail-like payment experience. To engage patients and improve consumer loyalty, providers need to find the right technology partners.

These vendors should offer modernized payment options that are adaptable and secure. These options should include access to third-party financing lenders who offer qualified, healthcare-specific recourse and non-recourse services.

The right technology partner can help ensure that regardless of the complexity, payments are auto-posted correctly, split effectively, and deposited into the correct account, reducing the burden on your treasury and revenue cycle teams.

Click here to watch the comprehensive webinar and learn more about choosing the right technology partner to update your revenue cycle and payment workflows.